For our clients, one benefit they receive by working with Miller & Newberg is that we can see trends emerging across multiple client companies, and then we use that knowledge to help each client better understand what is happening in their own company. The death claim impact of COVID-19 is an example of this.

Many of our client insurance companies and fraternal benefit societies mentioned to us that their death claims have been elevated in the first half of 2021, but that they aren’t sure why. Their claims departments have been looking for but not seeing many COVID-19 death claims, so they have assumed that COVID-19 isn’t significantly affecting their financials.

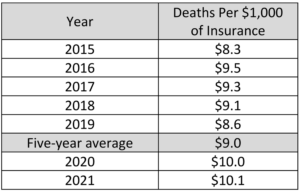

Here is what we see looking across our entire client base. In 2020, our client companies as a whole experienced death claims about 12% higher than a normal year:

Looking at data from the CDC (the Centers for Disease Control and Prevention), here is what the death rate has been across the country each of these years. In 2020, the United States experienced a death rate about 19% higher than a normal year:

The coincidence is too strong to ignore. It implies that whether companies realize it or not, the elevated death claims are almost certainly due to COVID-19.

The next question is, when will this stop? We can see from the CDC data that the peak in COVID-19 deaths occurred in the fourth quarter of 2020 and the first quarter of 2021. The country’s death rate was only slightly elevated in the second quarter of this year.

This means that many companies who were very concerned with their financial results after the first quarter then found the second quarter to be much more normal.

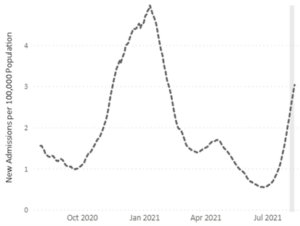

However, CDC data shows that COVID-related hospital admissions have been increasing through July and August, to levels that suggest we will again see an elevated death rate. This chart is taken from covid.cdc.gov/covid-data-tracker-new-hospital-admissions:

Thus, COVID-19 death claims will remain an issue for the life insurance industry. At Miller & Newberg, we will continue to monitor developments and report as updated figures become available.